Love the culture and excitement of urban life, but loathe the congestion and cost? One of these ‘second cities’ could be your first-choice retirement spot.

Raleigh, North Carolina

The pros of retiring in Raleigh: temperate weather and a strong economy for encore careers. The cons: There are fewer retirees than in other cities. Plus, some pension tax breaks will expire in 2014.

- Population: 431,800 (25% over age 50)

- Housing costs: $200,000 to buy a home/ $1,000 a month to rent

- Cost of living index: 93 (100 is average)

This state capital’s thriving economy and proximity to top universities have long made it a prime relocation destination. And recently more of those new faces have had a few wrinkles: From 2000 to 2010 the city’s population of 55- to 64-year-olds shot up by 97%, according to the Brookings Institution.

It’s not hard to see the draw: Raleigh provides a big-city feel with a low cost of living; mild, four-season weather; and, thanks to all those medical schools, world-class health care.

Where to live

Midtown/North Hills: Retirees looking for a good deal and a practical location should shop north of downtown, says local real estate agent Kim Crump. There you’ll find spacious townhouses starting at around $200,000.

Downtown: Those willing to pay about twice that price may consider the new condos and lofts downtown. “It’s stimulating to be around a young and diverse population,” says Jim Belt, now 62, who retired from finance in 2006 and along with his wife, Donna, moved from London to downtown Raleigh.

The couple say living in the center of things made it easy to get involved. Jim founded a downtown residents group. Donna, 59, started BEST Raleigh, a group that puts art in vacant storefronts.

What to do

Food: The city has a diverse restaurant scene, with everything from Afghan cuisine to Southern barbecue.

Music: The 5,000-seat Red Hat Amphitheater hosts the big acts, while the opera and symphony perform at the Duke Energy Center for the Performing Arts.

Art: A range of work is on display in galleries, public spaces, and parks. Or take in the 30 Rodin sculptures at the North Carolina Museum of Art.

Education: North Carolina State University’s lifelong-learning program offers affordable courses and study trips on topics including garden ecology and classical music.

Like most of the states in this gallery, North Carolina does not tax Social Security benefits. The state has no inheritance or estate tax.

- Income tax: 5.8% flat (starting 2014)

- Sales tax: 6.75%

- Median property tax: $1,800

- Population: 305,900 (33% over age 50)

- Housing costs: $149,450 to buy a home/ $1,100 a month to rent

- Cost of living index: 94 (100 is average)

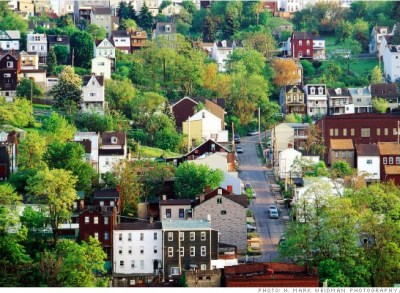

Talk about a comeback. At the turn of the 20th century Pittsburgh was an economic and cultural hub, home to Andrew Carnegie and other captains of industry. Then came deindustrialization and job losses in the 1980s. Now the city is polishing its rusty image by converting old mills and factories into office space, galleries, and lofts.

The once-dwindling population is also bouncing back; the city took the top spot in U-Haul’s 2012 relocation survey, with a 9% jump in transplants. For retirees, Pittsburgh offers a true urban experience, including good public transportation, pro sports, and a host of top universities, all at a bargain price.

Where to live

The Northeast and South: Jim and Deborah Bogen moved to Pittsburgh from California in 2000, when Jim, now 78, retired from the philosophy department at Pitzer College.

During a teaching stint at the University of Pittsburgh, he fell in love with the town, its 90 eclectic neighborhoods, and the green, hilly landscape. For Deborah, the move to a more affordable city had major practical implications. “If we hadn’t come here, I’d still be working,” says Deborah, 63, who retired from her paralegal job at age 50 and now writes poetry and novels.

Homes in popular neighborhoods like Highland Park (where the Bogens live) or the South Side are now fetching more than $300,000 or so, double what the Bogens paid. Still, many remain a bargain by other big-city standards. Plus, the area is easy to navigate on foot, providing an extra perk: “I lost 20 pounds the first year we lived here,” says Deborah.

What to do

Museums: The four Carnegie Museums span art, science, natural history, and a collective 1.3 million square feet. The Andy Warhol Museum is a local favorite (the artist grew up here).

Performance: Renovated concert halls are home to a thriving symphony, ballet, and opera.

Sports: Thanks to the Steelers, Penguins, and Pirates (who recently made the playoffs for the first time since 1992!), superfans can stay busy all year.

Outdoors: There are five large city parks, including the 561-acre Frick Park, where you can try lawn bowling or tennis.

Taxes

Distributions from most retirement plans, including qualifying 401(k)s and IRAs, are largely exempt. There is an inheritance tax, but there is no estate tax.

- Income tax: 3.07% flat

- Sales tax: 7%

- Median property tax: $2,450

- Population: 304,300 (29% over age 50)

- Housing costs: $162,400 to buy a home/ $900 a month to rent

- Cost of living index: 88 (100 is average)

Retirees looking to mix city activities with country charm will find a lot to love here. Lexington’s historic downtown is packed with galleries, restaurants, and boutiques. But drive just a few minutes and you’re in the rolling hills of Bluegrass Country.

The city is also home to one of the country’s oldest and most robust lifelong-learning programs, as well as the top-scoring University of Kentucky Albert B. Chandler Hospital, which has received accolades from the American Heart Association and National Cancer Institute.

Where to live

Downtown: Over the past decade, a crop of new condos and loft conversions has transformed the center of Lexington. Indeed, developers got a little overzealous during the boom years, says realtor Casey Weesner, so prices stagnated and condos sat empty in the wake of the housing crash.

The market has picked up in the past year, he says, but there are still some downtown bargains to be had. Expect to see modern two-bedroom condos priced around $200,000.

What to do

Sports: Welcome to basketball heaven. The Wildcats, the University of Kentucky’s powerhouse team, play at Rupp Arena, which also hosts shows and big music acts.

Education: Locals age 65 and older can sit in on university classes, sans tuition, whenever there are open seats. The school’s Osher Lifelong Learning Institute offers classes for the 50-plus set.

Arts: The campus also boasts the Singletary Center for the Arts. Downtown, the Kentucky Theatre shows independent and classic films.

Outdoors: Churchill Downs, home of the Kentucky Derby, is 90 minutes away. Bikers can hop on the 12-mile Legacy Trail, which leads to the equine events at Kentucky Horse Park.

Taxes

Up to $41,110 per person in retirement income is exempt. Homeowners 65 or older get a property tax break. Some family members are exempt from the inheritance tax.

- Income tax: Top rate is 6%

- Sales tax: 6%

- Median property tax: $1,620

- Population: 244,800 (39% over age 50)

- Housing costs: $108,000 to buy a home/$1,000 a month to rent

- Cost of living index: 94 (100 is average)

Can’t imagine retirement without a beach? In St. Pete you can dip your toes in the Gulf of Mexico or Tampa Bay — plus play a round of golf, eat virtually any type of cuisine, and see famous art, all in a single day.

While St. Petersburg is undoubtedly a retiree hotspot, the city has also drawn more young families in recent years, says local realtor Judy Horvath. The mix helps keep the city vibrant and stocked with boutiques, galleries, and restaurants.

Where to live

Downtown: The market for new apartments and condos was flattened by the bust, but developments are now back on track and in many cases selling out quickly. New two-bedrooms downtown start at around $300,000, says St. Petersburg agent Rachel Sartain.

Surrounding neighborhoods: If that’s too expensive, going five or 10 minutes outside of downtown brings prices down dramatically; condos in many central areas start in the $200,000 range, says Sartain.

What to do

Beaches: Two of the nation’s best (according to TripAdvisor readers) are just a 10-mile drive from downtown, including North Beach, located in the 1,140-acre Fort De Soto Park.

Art: Try the Dalí Museum for works by the Spanish surrealist, or the Museum of Fine Arts for Monet and O’Keeffe.

Sports: Tropicana Field is home to the Tampa Bay Rays. There are also plenty of golf courses, including Mangrove Bay, a par-72 championship course. At $25 a round, these municipal greens may be the city’s best bargain.

Taxes

Retirement income is not taxed. Permanent residents get a property tax exemption of up to $50,000.

- Income tax: None

- Sales tax: 7%

- Median property tax: $1,080

- Population: 213,000 (32% over age 50)

- Housing costs: $137,020 to buy a home/ $900 a month to rent

- Cost of living index: 94 (100 is average)

Moving to a mountain town means easy access to skiing, hiking, golf, fly-fishing, and more. Unfortunately, it also usually means jaw-dropping home prices, a dinky airport, limited health care, and tourists galore. Not in Boise.

Yes, locals here can ski at Bogus Basin 16 miles from downtown, stroll or bike 85 miles of trails, and paddle or fish on the Boise River, which runs through town. But they’ll also find low taxes and affordable homes.

Plus, Boise has become a nucleus of culture and health care. Saint Alphonsus Regional Medical Center is ranked in the top 5% of hospitals nationwide for clinical performance.

Where to live

North and East of downtown: Prices in the city center are steep, so buyers should concentrate on the surrounding neighborhoods, says Boise real estate broker Jason G. Smith. “Traffic isn’t an issue,” he says. “So you don’t need to be right downtown to enjoy it.”

You’ll find two-bedroom condos or small single-family houses priced at about $300,000 in the North End.

Southeast and Northwest Boise: On a tighter budget? Head to these neighborhoods (located about 10 minutes from the city center) for homes starting around $200,000.

What to do

Outdoors: Walk along the Boise River Greenbelt or explore the trails winding out of Hull’s Gulch or Camel’s Back Park. The city has two open-air Saturday markets, which are a great place to find produce and bump into friends.

Art: The Boise Art Museum has 3,000 permanent works and presents diverse exhibitions ranging from site-specific installations to collections of ancient artifacts.

Performance: Grab tickets for the opera, philharmonic, or ballet. Boise State’s Morrison Center hosts national tours of Broadway shows, stand-up comedy, and live music, while the Shakespeare Festival fills a 770-seat outdoor amphitheater.

And there’s more to come: Construction is under way for a new $70 million, 65,000-square-foot cultural center, slated to open in 2015.

Taxes

Retirement benefits are taxed, though some types of pensions qualify for a deduction. There is no inheritance or estate tax.

- Income tax: Highest is 7.4%

- Sales tax: 6%

- Median property tax: $1,230

- Population: 167,000 (39% over age 50)

- Housing costs: $216,000 to buy a home

- Cost of living index: 111 (100 is average)

Though often thought of as a vacation destination, Fort Lauderdale has plenty to offer residents: no state income tax, amazing weather, abundant health care, and a bustling city center, for starters. Home prices have worked their way back to pre-bust levels but remain reasonable relative to most beach destinations.

And even if you don’t spring for oceanfront property, chances are you won’t be far from the water: More than 150 miles of canals weave their way through this small Florida city.

- Population: 193,500 (25% over age 50)

- Housing costs: $137,446 to buy a home

- Cost of living index: 97 (100 is average)

Tame traffic, bike lanes, and the light rail make getting around Salt Lake City a cinch, whether you live in a restored Victorian in the artsy district known as “the Avenues” or in a new condo downtown.

The city has all the best urban amenities including two dozen museums, world-class health care, and direct flights to Paris. Still, locals also love SLC for its proximity to the Wasatch Mountains.

Utah does tax Social Security benefits, but the 5% flat income tax and low cost of living help keep the city affordable.

- Population: 434,400 (31% over age 50)

- Housing costs: $210,000 to buy a home

- Cost of living index: 96 (100 is average)

Colorado Springs pairs a bustling downtown with access to parks, trails, and the Rocky Mountains. The city, which was spared the worst of the recent flooding in the area, is also less congested and expensive than nearby Denver.

Residents have great health care choices, including the University of Colorado’s Memorial Hospital, one of the leading cardiovascular hospitals in the country.

Income taxes are a reasonable 4.63% and exclude up to $24,000 in Social Security and other retirement income.

Abundant sunshine, affordable housing and cultural events make Spokane an excellent retirement choice.

- Population: 215,300 (32% over age 50)

- Housing costs: $146,180 to buy a home

- Cost of living index: 97 (100 is average)

Unlike gloomy Seattle, Spokane basks in about 260 days of sunshine a year. Want to get out and soak up that vitamin D? The Spokane area has 76 lakes and five ski resorts, plus plenty of golf courses and wineries.

The city has urban appeal too, with a downtown that’s become a destination for retirees looking to trade high maintenance homes for condos that are walking distance from restaurants, art galleries, and theaters.

Spokane residents do pay a hefty 8.7% sales tax, but the state has no income tax.

- Population: 245,800 (25% over age 50)

- Housing costs: $189,950 to buy a home

- Cost of living index: 100 (100 is average)

Water lovers can’t go wrong settling in Norfolk, a prime jumping off point for sailing or kayaking the Chesapeake Bay, the Atlantic, and several nearby rivers.

Landlubbers can stroll miles of beaches, feast on seafood, and take in some culture at the city’s own opera, theater company, and orchestra. The Chrysler Museum of Art houses a massive glass collection, along with everything from Egyptian art to modern masters.

Virginia levies a 5.75% top income tax rate, but qualified seniors can deduct some retirement income.

Downsize your ride

Switching to a small car will make squeezing into tiny parking spots easier, and the fuel savings will add up fast. Going from a midsize to small car could save you more than 25% in gas costs.

…or drop it completely

If your new home has good public transportation, you might be able to go car-free. Use a car-sharing service such as Zipcar (which starts at $8 an hour) for errands and weekend trips.

Edit your stuff

City homes are small, and storage is pricey, so toss or donate anything you haven’t used in a year, says pro organizer Anna Lieber. With donations, get a receipt in case you’re audited.

Become a member

Get cultured without going broke. If there’s an institution you love, join. A $50 senior membership to Pittsburgh’s Carnegie Museums, for one, pays for itself after four visits.

Follow

Follow